how to file back taxes without records canada

The IRS prefers that you file all back tax returns for years you have not yet filed. How Long To Keep Tax Records Business Documents Blue Pencil.

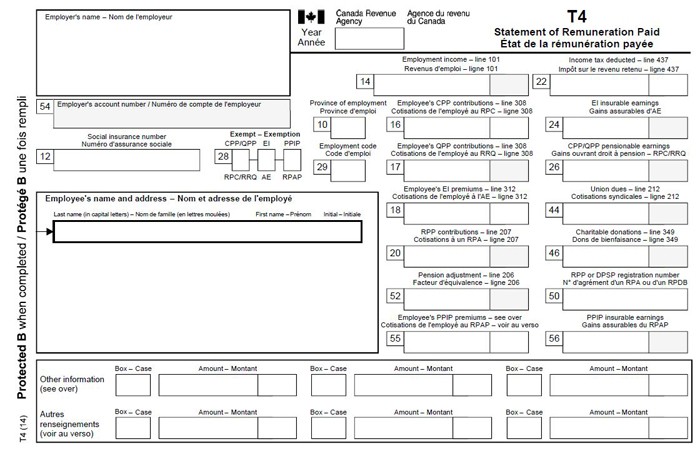

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How Long Should I Keep.

. Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A. Youll need to have handy your Social Security number or individual taxpayer. To file your taxes enter your information through the automated phone line.

Ad Based On Circumstances You May Already Qualify For Tax Relief. You can still save yourself from IRS penalties if you have missing or incomplete tax records. The first step is gathering any information from the.

How to file back taxes without records canada Wednesday June 15 2022 Edit. The longer you go without filing. Provide Tax Relief To Individuals and Families Through Convenient Referrals.

TurboTax Tax Tips Videos. Read the article to learn how to file back taxes without records. For most business owners the best and fastest way to get your tax transcripts is through the Get Transcript Online tool from the IRS.

If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040. The penalty for filing taxes late is 5. Prepare the tax return from the clients documents.

The IRS was perfectly comfortable with the newly filed returns and it ended up being a simple. Ad Based On Circumstances You May Already Qualify For Tax Relief. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for.

The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. If you have not filed your tax return and you are entitled to a refund did you know that the deadline for you to claim the refund is 3 years from its due date including extensions.

Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals. However this is only the. Its easiest to pay every month to avoid a.

You cant file a return. Using all this information Patricia was able to successfully file all of Jakes delinquent returns. Provide Tax Relief To Individuals and Families Through Convenient Referrals.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. You can also order a tax return or tax. How far back can you go to file taxes in Canada.

That said the IRS usually only requires you to file the last six years. Invited people with a low or fixed income and a simple tax situation. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

How to file back taxes without records canada Thursday September 1 2022 Edit. This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit information on all of these years. However to properly use tax accounting software and learn how to file back taxes without records.

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Calculate Gross Income Income Calculator Personal Services

Notice Of Assessment Reassessment Everything To Know Kalfa Law

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Small Business Bookkeeping Template Simple Income Expense Etsy Bookkeeping Templates Bookkeeping Small Business Bookkeeping

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

I Finished Filing My Taxes What Now 2022 Turbotax Canada Tips

How To File Taxes In Canada As A Freelancer Step By Step Guide

How To Prepare And File Your Canadian Tax Return Dummies

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube